31

May

2023

31

May

2023

ISET Economist Blog

Friday,

19

October,

2012

Friday,

19

October,

2012

Friday,

19

October,

2012

Friday,

19

October,

2012

Economics suggests that competition in a market brings more welfare to a country. Anti-monopoly agencies exist to create policies that limit market dominance and achieve competition. There are, of course, cases when natural monopolies emerge (for example, railways – where no one would build a parallel line to an existing one) and the solution to prevent monopolies in such instances is to regulate the businesses or take them into state ownership. It is, however, difficult, but not impossible, to find an instance when a market is competitive, but where no competition among players is observed. While there has been much talk about monopolies or oligopolies in different sectors in Georgia, there is one sector where one can find this; where the market is unconcentrated but in which no competition takes place. The electricity generation sector. Why do small hydropower plants (SHPP) not compete with each other?

According to the Georgian National Energy and Water Regulatory Commission (GNEWRC), a regulatory authority, at the beginning of 2012, there were 13 companies licensed to generate electricity in Georgia. There are also 33 SHPPs, which do not need a special license but have the privilege of selling the electricity generated to all interested parties, including households and small businesses. These privileges can serve as an instrument for attracting investments in SHPPs, which would benefit both the SHPPs and other businesses. How can this model work?

On the supply side, the SHPPs have an incentive to sell the electricity they produce at the highest price to make the highest possible profit. On the demand side, there are companies involved in different sectors (such as agriculture, tourism, education, and healthcare) that have the same aim of maximizing profit and, as electricity accounts for a noteworthy share of their costs, they should be interested in getting cheap energy. Having intensive electricity trading among SHPPs and business representatives will be beneficial for both sides and increase the incentives for SHPPs to supply more.

But allowing SHPPs to trade with all interested parties does not mean that trading will actually take place. Generally speaking, the reasons that intensive trading might not be happening are:

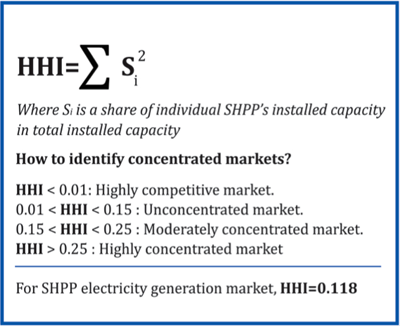

The Herfindahl-Hirschman Index (HHI) is often used to measure the competitiveness of markets. By estimating market concentration (competitiveness) using the HHI we find out that the SHPP generation market is unconcentrated, meaning that none of these generators can affect prices. So, we have a competitive market with no competition. Why might this happen?

From my personal experience, awareness amongst businesses about the opportunity to trade directly with SHPPs is very low. This is one of the reasons why there might be disruption, even though the vast majority of SHPPs can supply electricity for several businesses simultaneously.

To promote SHPP construction, there is a policy allowing SHPPs to sell their electricity to the Electricity System Commercial Operator (ESCO) at a predefined tariff. ESCO buying the electricity generated by SHPPs cuts the incentive for them to search for other clients. Even though the SHPPs can sell electricity at a higher price, they agree to cooperate with the commercial operator. The efficiency of such a policy can be called into question and needs to be examined. Another issue is whether the distribution companies would welcome such changes. Strong legislative instruments would thus be required to deal which potential problems in this direction. These reasons might kill competition in a competitive market. Somehow supporting trade among businesses and SHPPs may be the best option for attracting investment in SHPPs, which, at the same time, would benefit the businesses.